[button link=”https://www.arredanegozi.it/2013/01/osservatorio-quanti-negozi-devono-chiudere-in-italia/” icon=”none” target=”” color=”a30b0b” textcolor=”ffffff”]TESTO ITALIANO[/button]

This article examines a hot issue: the inevitable restructuring of many retail sales networks.

Opening a brand store has certain fixed costs but the potential return is open to doubt: this is the grim reality of the situation.

It is natural to wonder whether more foresight could have been shown beforehand; in the last few years the expansionist policies of commercial networks, like those of large retail complexes, have followed differing and largely incomprehensible strategies, apart from achieving an immediate growth in liquidity and profits from property development.

It would be pointless to deny the fact that the current situation in Italy suggests that there may never be a return to the levels of consumption of the past, not just due to the simple lack of money. It is a more deep-rooted change, linked to the boredom caused by the sense of saturation from shopping. Retailers are at least partly to blame for this.

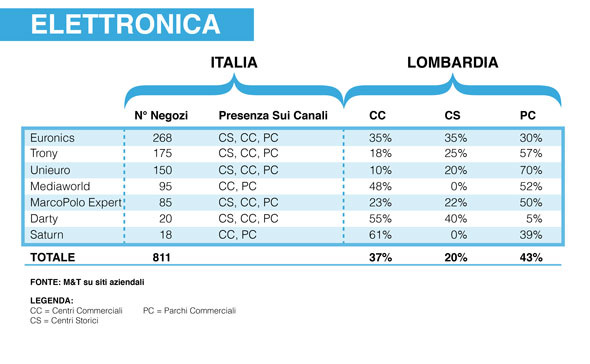

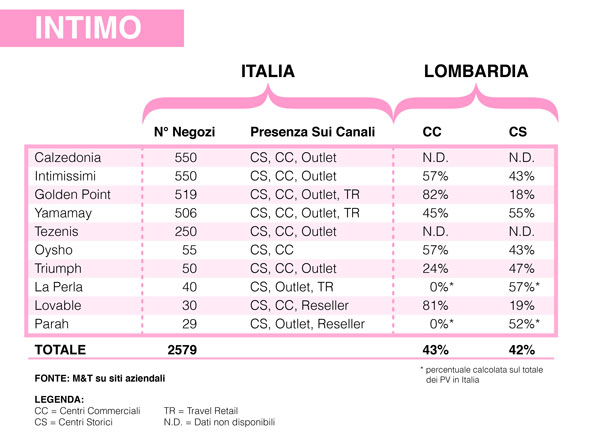

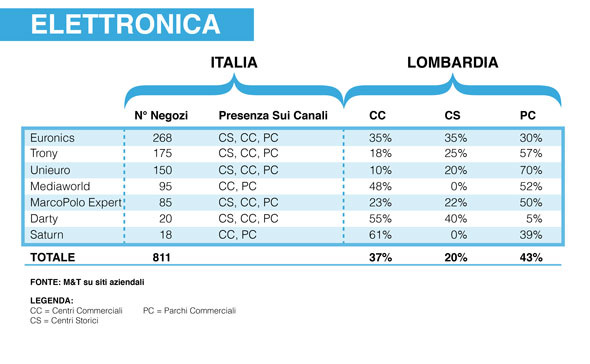

Here are a few statistics: in Italy there are currently about 2,600 shops of the main lingerie and underwear chains (about 580 Yamamay stores and more or less the same number of stores for Calzedonia, Intimissimi and Golden Point). They are all situated alongside each other in a never-ending series of shopping malls and urban shopping streets.

Things are not very different if we consider the 900 consumer electronics stores, the 2,700 perfumer’s, the 2,000 children’s clothing stores, or, just to take the region of Lombardy, the 600 telephone company stores.

The map of retailing networks in Italy (source: Mark Up 2012) shows that there are now 1,055 shopping complexes of all types and sizes (with a total of almost 33,000 shopping units), in addition to which there are also 28 outlet shopping centres and 164 retail parks.

Considering that the Italian population was calculated to be almost 60 million at the last census, there is now a shopping centre for every 56,000 thousand individuals, including newborn babies and ninety year olds…

The exorbitant number of shopping complexes (even in the period of prosperity) with respect to the potential demand of the market, is now, given the current recession, an absurd situation and requires a serious rethink of companies’ marketing and sales strategies.

If we look at a qualitative analysis of the data, what emerges is that all brands, with few exceptions, control all the distribution channels (shopping centres, historic centres, outlets, travel retail stores). Within these channels, overlapping is the norm as is the lack of homogeneity of the formats in terms of size, average sales, and profitability. Everything is scattered all over the place in chaotic fashion.

In the historic centre of Milan, the same brand can be found at two brand stores only 500 metres apart from each other, even in shopping streets or more specialist shopping areas, although the first store may be about 70 sqm while the second is 200 sqm.! It is worth analysing the business concepts; if we take consumer electronics as an example, we are faced with successful ideas that date back to the eighties and no longer coincide with people’s consumer habits although they have extremely high running costs for retailers (a further problem…). In 1500 sqm. you will find next generation tablets together with food processors, as well as books, water filter jugs, electronic games, and 3D televisions costing 1,500 Euros. Not to mention the chronic lack of customer advice on purchases or after-sales and problem-solving services.

As an example, we could take an area of Milan and its hinterland. In the 20 minute isochrone of the north eastern area we can find as many as 17 shopping complexes situated essentially along the route of the A4-northern link road, a stretch of about 35 km in all, within a 25 km radius from Cinisello Balsamo.

There are clearly too many shopping complexes situated too close together. Even in the most optimistic scenario, such a vast supply of shopping opportunities is difficult to sustain.

If we enter them and focus solely on the quality of the products on offer, ignoring the pitiful overall shopping experience, we realise that the situation is even worse than the statistical evidence suggests. The basic problem is that they are all the same.

The same brands and signs, the same lack of positioning: in terms of the presence of the same brands, there is a 47% overlap between the “Metropoli” shopping centre and the “Carosello” shopping centre, a 56% overlap between the “Metropoli” shopping centre and the “Il Globo” shopping centre and a 39% overlap between the latter and the “Vulcano” shopping centre.

These are just a few examples that support my main point: in other words, even before the crisis in consumer spending, the problems of shopping centres in attracting consumers depended on a crisis in positioning, strategy and initiative.

Of the most widely found brands (if we consider the case of 13 shopping centres out of 17, with a 77% overlap), we find the following: Intimissimi, Kasanova, Goldenpoint, Motivi, Oltre, Salmoiraghi e Viganò, Gamestop, Fiorella Rubino, Bluvacanze…

The most inflated sectors still seem to be those of lingerie and underwear and electronics.

It is not simply being pessimistic to argue that the situation inevitably needs a radical overhaul; it is necessary to close and rationalise retail networks that have expanded beyond all reasonable limits and maybe take advantage of new, more promising and differentiated retail opportunities. In many cases, there is inevitably a high price to pay, both in economic terms and in terms of image. But there are few alternatives.

What may make the difference is the way in which the decisions to restructure the network are taken.

The size of demand is not going to be explained by examining more isochrones and barycentres, but rather by a more qualitative assessment of the overall functioning of the retail area which takes account of the following factors:

- Marketing and sales strategies for the development of retail networks need to be consistent with the brand’s positioning by choosing the most suitable channels for supporting and enhancing the brand

- It is worth re-emphasizing that different channels and locations have different customers and/or functions. Commercial stereotypes like “the family” and “the housewife” no longer exist

- If the use meanings for people change, then retailing concepts need to change and adapt

- The opening and running of a sales outlet – business in general – follow precise rules in terms of its profitability, average sales, costs and returns per sqm.

- The Internet has created a better-informed and more demanding type of consumer; the sales outlet must exalt and enhance the specific features of the physical environment of retailing or else equip itself as a showroom for collecting goods.

It should be obvious from the above discussion that retailers must prepare themselves for a very different approach to their work compared to what has been done in the recent past.

Yesterday, the watchword was: OPEN, OPEN, OPEN. Today it should be modified into: ENDURE, PRETEND NOTHING’S HAPPENING, GOING INTO LIQUIDATION OVERNIGHT.

Perhaps there is a more sensible and fruitful middle way: thinking ahead.

●by Carlo Meo, Managing Director of M&T

© by AN shopfitting magazine