[button link=”https://www.arredanegozi.it/2014/03/strategia-shop-in-shop/” icon=”none” target=”” color=”a30b0b” textcolor=”ffffff”]TESTO ITALIANO[/button]

In this AN shopfitting magazine issue we would like to take you shopping on a journey of the senses through the world of the Shop in Shop retailing concept.

We shall briefly analyse some of the winning aspects and other aspects to avoid in order to invest in the Shop in Shop strategy, beginning from a reflection on market developments and the importance of visual merchandising.

Over the last ten years, every aspect of the sales market has changed and we are currently experiencing a crisis in consumption. Together with the loss of customer purchasing power, we have simultaneously witnessed an increase in a new sales strategy: online marketing. Albeit slowly, e-commerce has become a part of the daily lives of relatively young consumers, shifting 3% of the in-store purchase of goods and services to online purchases. In 2013 this form of purchasing increased by 14%, almost reaching 9.9 billion euros (source: pmi.it_smau observatory) and the forecast trends for the following years look positive.

There are many causes of the rise of e-commerce, in particular the overall saving in terms of “effort”, money, and the freedom to compare and choose products. Consumers have changed over the last 10 years. Until 1993, consumers would buy superfluous items whereas nowadays they purchase only what is strictly necessary and think carefully before making a less important purchase. But why are we looking at e-commerce if we intend to talk about Shop in Shop retailing? To answer this question, we should begin by considering the shopping experience that we offer consumers and that is generated in the two sales channels, the trump card that triggers most impulse buys.

To get a better understanding of the subject, let’s begin with an extremely simple comparison. We can imagine a beautiful body dressed in a standard tracksuit, a body that does not match current standards of beauty dressed in a trendy tracksuit and the page of an e-commerce web site that shows just the tracksuit. People will undoubtedly be attracted by the beautiful body because the structure helps to enhance the product even though it is not a well-known brand or the latest fashion. In this case, attracting attention and a seductive image count for more than offering a beautiful product.

Although combined offline and online strategies can help to generate greater profits, we would like to keep the store alive and preserve the shopping experience that the web can never replace. We would like to take you shopping at a store, to enjoy the smell of new garments, to try on clothes in the changing room, and to enable you to touch the silk and the porcelain. We want to take you inside the store and get you to use all 5 senses to offer a brief analysis of several strategies that can be employed to attract customers.

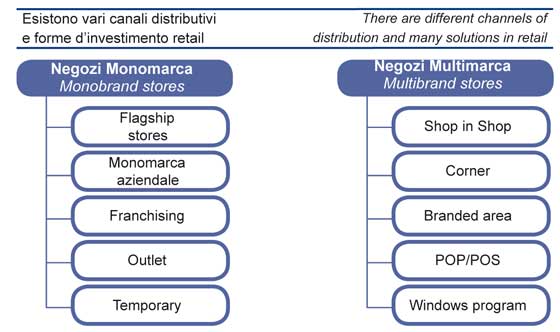

In the pyramidal structure of retailing there are various types of investment and strategies that a company can pursue.

The first consists of company-owned stores where the brand has complete room for manouvre in terms of management. The image, staff and selection of products represent the real expectations of the brand. The company-owned store is therefore the most prestigious concept. We also find the concept of the flagship store which represents the highest level of retailing. It is a “sales container” which, in terms of fittings, products and service, offers the state-of-the-art of the brand in question.

The franchise formula is similarly ambitious even though it revolves around a partnership with the franchisee with whom it is necessary to be completely aligned for all aspects of store management.

In the wholesale or multi-brand channel there are still essentially two main types of layout: the branded area and the shop in shop retailing concept. These investments are based on the relationship with the most commercially significant retailers and with the stores where the presence of an area creates a brand image and ensures the goods are sold out. In this case too, the partnership underlies the success of the branded area or shop in shop strategy which generally involves a duration of the display area that lasts at least 6 sales seasons (about 3 years).

The branded area simply means customising an area devoted to the brand and generally does not exceed 50/80 sq. m. It is a relatively expensive investment which aims to “decorate” the fittings and layout of the store through key features such as images, graphics, POP (Point of Purchase) material and decorative accessories.

The shop in shop retailing concept involves full-scale decoration of the sale area that the dealer makes available to the brand. The fittings, which are much more extensive than the “branded area” concept, can therefore include fittings and furnishings, lighting, flooring, photographic images and anything that can create emotional entertainment, and often comes with the support of a specially trained sales assistant.

Lastly, there is the pop-up or temporary store. This kind of store is of a temporary nature and may last for a period ranging from a few days to just over a month. Despite being small and transitory, these stores are often able to attract the interest of consumers. They appear in particularly conspicuous parts of a city, offering the latest products and can close suddenly without warning: the aim is to create an ephemeral event linked to a temporary message with a lasting effect, especially in the marketing strategies of leading brands.

While on the subject of pop-up stores, we would particularly like to mention the latest concept developed by Diesel Brave Kids at La Rinascente store in Milan where, in the area devoted to kids’ clothes, the company based in Marostica has installed a striking structure with an extremely attractive selection of products. In about 40 sq. m. of space we can find the essence of Diesel clothing targeted at younger customers both in terms of entertainment and type of product.

With regard to the shop in shop approach, we decided to visit, together with our readers, one of the historic stores which, however, has always been at the forefront in terms of the assortment and presence of Italian brands: “Sorelle Ramonda” in Alte di Montecchio Maggiore (Vicenza).

“Sorelle Ramonda” is a group that has built up a prestigious reputation since the twentieth century and is geared towards innovation. In the wake of initiatives launched at La Rinascente, it has introduced the Shop In Shop concept into its store. The philosophy of Sorelle Ramonda is clearly represented within its stores situated around Italy. It is strongly rooted in the local area and this is reflected in the close partnerships with the leading names of Italian haute couture. The close bond it has created with its customers has never been broken due to the versatility of its product range and excellent value for money.

On entering Sorelle Ramonda you find yourself in a large shopping environment that greets customers with a long wooden counter typical of the nineties. The retail area is subdivided into menswear, denim, sportswear, underwear, women’s clothing, kids’ and baby clothes, toys, household products and other categories of goods.

There is also an area devoted to jewellery and perfumes and, although the display areas are clearly defined, there is no set route that leads customers in a specific direction encouraging them to visit the whole store. One of the first sensations you get on entering is that you are in a “shopping wonderland”, the only defect being that it is rather disorganised. Although there is no set route that enhances all the areas of the brands, customers are naturally led towards the right-hand part of the store where they enter the “denim” and menswear sections due to the counter that channels the flow of customers in this direction. In this area, the shop in shop outlets of brands such as Guess, Diesel, Meltin Pot and Levi’s are just some of the ones we visited. However, in general, all the outlets are well-displayed with areas ranging in size from 8 sq. m. to 12 sq. m. Most of the areas specialising in denim are overseen by staff from the store or experts commissioned by the respective brands; moreover, at least 90% of the brands that have an area within the centre constantly send Visual Merchandisers to increase visibility – as was revealed in an interview with Ivo Marzari – head of the denim clothing area. Overall, no errors were found in the display techniques even though – it has to be admitted – in the area devoted to a well-known brand of denim garments we noticed a headscarf placed on PoP (Point of Purchase) promotional material. At this point alarm bells immediately started ringing because the mistaken display technique made it impossible to read the message on the PoP; however, this slip was remedied by a good “spotlight” display on a pair of jeans on the wall above. Luckily, this dynamic visual display distracts the attention of customers, at least in part, from the PoP material in question. Almost all the brands have displays that distinguish the brand with the appropriate colours and suitable matt tones. There is also a good distinction between the different brands. Mark for jeans and denim area 9½/10. We then put several questions to Ivo Marzari_Head of the denim clothing area

D: How have these corners developed within the store over the last 10 years?

R: Over the last 10 years I have observed an increase of about 70% in the corners regarding the denim sector

D: Do the denim brands in the store provide Visual Merchandising assistance?

R: 90% of the companies with a brand area provide fairly frequent support in the form of Visual Merchandising

D: What do customers like about this type of retail presentation?

R: Customers are particularly appreciative of the prices but they are also strongly attracted by the quality of the products.

We shall continue our tour by taking a rapid glance at the “menswear” area with mainly medium-high fashion brands such as Canali, Tommy Hilfiger, U.S Polo, La Martina, Paul&Shark, Pal Zileri or Ermenegildo Zegna. No significant mistakes in display techniques were observed, but let’s look at a few details that could make the difference in terms of visibility and the sensorial experience for consumers.

Imagine three brands belonging to different companies included in the same display context; two of these brands have medium-high market positioning, so the fact that they were displayed on anonymous structures belonging to the store and too close to other brands did little to enhance their positioning to the full. We noticed a display area with a renowned brand with “Luxury” level market positioning displayed in a confused fashion, especially with regard to creating specific moods. This problem was counterbalanced by a well-designed structure in solid wood that emphasised the elegance and importance of the fashion house. The menswear area has many expert assistants, the majority of whom are male, ready to give advice to anyone who loves a sophisticated, classic look. Mark for menswear area 7½/10.

We shall now move on to the sportswear area where we encounter Freddy, Champions and Converse although these are just some of the brands at Sorelle Ramonda. All the areas are well-displayed using visual merchandising techniques, some with assistants and others without anyone. It feels like being in a shop selling sportsware. The area does not convey particularly powerful emotions. The brands display the garments as if they were in a standardised exhibition of paintings, as if the object were making the following statement: “I’m here, I’m a good product, look at me and, if you want, you can buy me”. Mark for sportswear department 6/10.

As we go into the underwear department we observe several areas where the play of light creates interesting visual effects that highlight the brightness of the colours in this section like pale pink or cream. There is a refreshingly cool atmosphere that gives us an “intimate” relationship with the product due to the fact that the display areas are much smaller than the rest of the store. We are suddenly attracted by the Shop in Shop outlet of La Perla which is much larger and more spacious than the others. The garments and the atmosphere stand out due to the contrasts of light and shadow. The different perspectives have been created using flooring units customised with romantic details that are typical of the brand. Due to the fittings and visual merchandising techniques, the Shop in Shop outlet of La Perla has effectively conveyed an intimate, refined atmosphere where customers are at ease and feel free to make a purchase in pleasant and cosy surroundings. Mark for underwear department 9½/10.

We have finally reached the department for kids’ and baby clothes ranging from the sweetness of Chicco to the more mischievous look of Pepe Jeans or Diesel Kid. The surface is clearly divided into baby clothes and kids’ garments and, like other departments, there is an extremely wide selection of brands: both smart casual items and clothing for special occasions. Most of the brands that have a display area do not provide a visual merchandising service or specialist staff. The reason for this is still hard to understand, especially because we have noticed several points where it would be advisable to intervene. More specifically, there are several parts of the store where you get the feeling that there has been little planning. The sizes of the clothes seem to have been positioned without any consistency while some basic mistakes have been made in the choice of colours.

The semantics of colour underlies the semiotics of the product. Colours play a crucial role in attracting customers because each colour corresponds to an emotion and each emotion corresponds to a psychological state as perceived by our unconscious which can influence sales.

Colours take on special significance when designing a shop in shop outlet that stands next to the outlet of a rival brand. As in this case, colour becomes a crucial tool for attracting customers; if the structure in which the goods are displayed is anonymous and similar to the structures of other products, Visual Merchandising is probably one of the few solutions that brands can use to make the purchasing experience as enjoyable as possible. In this department there are very few brands with customized fittings designed to make the products immediately recognisable to consumers: the exceptions include Pepe Jeans and Diesel Brave Kid and interestingly, as emerged from a brief exchange with two assistants, these two brands were the ones with the highest sales. Was this perhaps due to the fact that their distinctive nature stood out from all the other brands? Probably.

Although Visual Merchandising is at least 60% responsible for in-store purchases and can convey emotions, this does not imply that the success of sales is simply due to this. We are not deterministic and we are fully aware that success derives from a mixture of marketing strategies. Mark for baby clothes and kids’ wear department 6½/10.

We have now almost reached the end of our day’s shopping and we have finally come to the women’ clothing department where there do not seem to be any noticeable errors in the display. Women’s clothing brands mainly consist of customised fittings such as Desigual, Max Mara Weekend, LiuJo, Paul&Shark, Twin-Set by Simona Barbieri and Silvian Heach, although there are examples of poor image management. We observed certain imprecisions that were detrimental to the brand in question: the section devoted to a well-known Italian brand of clothing and footwear featured two shelves without displays which covered the brand logo. The product was just placed without any sense of form, volume or a mixture of accessories and the display failed to convey any sense of emotion. The final error we detected was a garment of a brand that was on the hanger marked with the name of another brand. It is rather like buying an Etrò garment in an H&M shopping bag. Our mark for the women’s clothing department is 7½/10.

We have come to the end of our little tour of the store. Despite a few oversights, we were generally satisfied with the store and hope that you enjoyed the afternoon’s shopping.

by Paolo Zanardi and Francesco Zabini

©by AN shopfitting magazine